Kura Sushi USA: Too expensive to pay despite rapid growth (NASDAQ: KRUS)

luchezar/E+ via Getty Images

Unique restaurant concepts have the potential to generate significant growth which, in turn, can create real value for long-term investors. One such restaurant chain that has started to grow at a rapid pace is a small company called Kura Sushi United States (NASDAQ:KRUS). This particular entity combines both technology and Japanese cuisine to create a unique experience for its customers. And after the company enjoyed tremendous success across Japan over the past few decades, management ended up bringing the company here to the United States. While the company’s growth prospects are unquestionably attractive, share prices are at levels that today are very difficult to justify. So while the company may ultimately turn out to be a good growth story, only investors who don’t mind paying a hefty premium for that growth should consider taking a bite out of it.

An interesting piece on Japanese cuisine

Over a period of more than 35 years, Kura Sushi has grown from a unique concept in Japan to approximately 480 locations. Then, in 2008, the company’s management team established a subsidiary that eventually opened its first location in California. The company’s current operations involve selling what management describes as authentic Japanese cuisine. This includes various types of sushi which the company claims is made from high quality fish and 100% organic rice. Even the company’s vinegar comes from Japan. This care extends to their other food products, such as their broths which are homemade every day, as well as the various side dishes and desserts that the company offers. In total, the company’s menu allows customers to enjoy a variety of dishes, with more than 130 different dishes available.

When it comes to serving customers, the company uses what it provocatively uses a rotating sushi concept where food is placed on a conveyor belt which passes the food through customers’ tables. The company prides itself on playing the sound of animated videos on touch screens at the edge of the table and offers various stages for diners, such as distributing a Bikkura-Pon toy for every 15 plates placed in the plate slot. While that might seem like a lot, these plates come in small portions, with the majority of his menu priced around $3 per serving.

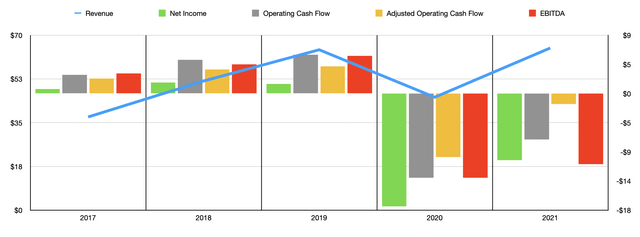

Author – SEC EDGAR Data

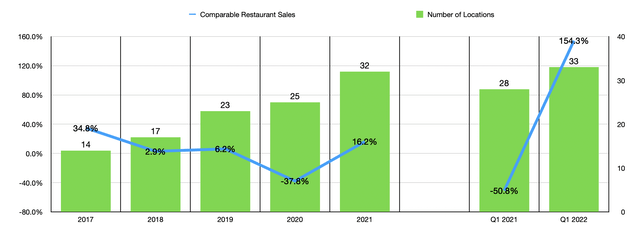

Due to the COVID-19 pandemic, it is difficult to understand the company’s true growth prospects in recent years. But the data we have seems encouraging. Between 2017 and 2019, for example, the company saw the number of locations it operates grow from 14 to 23, and comparable restaurant sales increased 47.3% overall, driving the company’s sales from $37.3 million to $64.2 million. Then, in 2020, the COVID-19 pandemic hit, dropping sales to $45.2 million even as the number of restaurants for the company grew from 2 to 25. A major factor in this drop was was a 37.8% drop in comparable restaurant sales. As the economy began to open up again, the company saw something of a rebound in revenue. Revenue increased in 2021 to $64.9 million. This came as the number of restaurants grew to 32 and comparable restaurant sales increased 16.2%. But even that is rather complicated by the timing of the reopening of the economy.

Author – SEC EDGAR Data

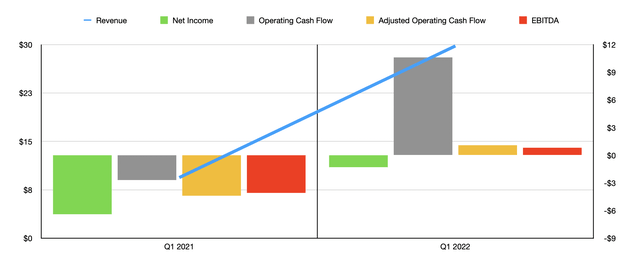

What is better is to consider how the business should fare in the current fiscal year. With management anticipating opening 8 to 10 new restaurants, each costing about $2.1 million and covering about 3,400 square feet, the company expects revenue to total between $130 million and $140 million. dollars in 2022. While this may seem like a stretch compared to what the company generated last year, we can already see the performance for the first three months of its Financial year 2022. Revenue for this period was $29.8 million. That’s up from the $9.4 million generated a year earlier. This growth is attributed to a 154.3% increase in same-store restaurant sales and the company’s number of locations increasing from 28 to 33.

Author – SEC EDGAR Data

Like many fast-growing companies, Kura Sushi USA is struggling on its bottom line. Between 2017 and 2019, the company’s net profits remained in a fairly narrow range of between $0.7 million and $1.7 million. The company then lost $17.4 million in 2020 with a further loss of $10.3 million last year. Other profitability parameters also deserve consideration. Between 2017 and 2019, cash flow from operations decreased from $2.9 million to $6 million, while this figure without working capital adjustments would have decreased from $2.3 million to $4.2 millions of dollars. But then, in 2020 and 2021, both of those metrics turned negative. EBITDA was also negative, with a deficit of $10.9 million for 2021 after seeing the period from 2017 to 2019 drop the measure from positive $3.1 million to positive $5.8 million.

As revenues improved, the company’s profitability also showed signs of improvement. Net profit for the first three months of 2021 was negative at $1.3 million. That compares to the $6.4 million loss incurred a year earlier. Cash flow from operations went from a negative $2.7 million to a positive $10.6 million. But if we adjust for changes in working capital, it would have gone from a negative $4.4 million to a positive $1.1 million. Additionally, EBITDA also improved from a negative $4.1 million to a positive $0.8 million. Unfortunately, the management did not provide any indication regarding the 2022 financial year. And this makes the analysis of the company particularly difficult. Because the results we have from previous years have been negative, while the revenue growth from the last positive year, 2019, is expected to be significant, meaning we can’t really know what kind of profit the business would generate now. in fact, it requires some speculation on my part. So I assumed, taking the difference in revenue between 2019 and what is projected for 2022, that profitability and cash flow should increase by the same percentage.

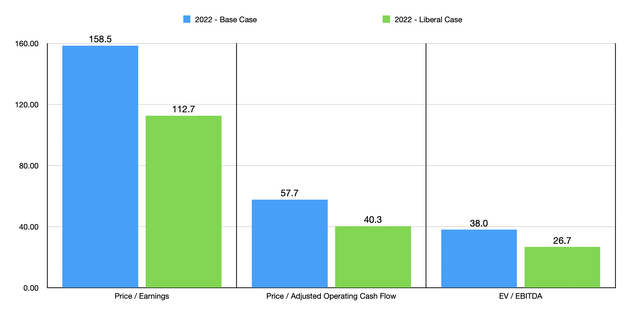

Author – SEC EDGAR Data

Taking these numbers, we can see that the company’s shares are trading at rather high levels. On a forward-looking basis, the company trades at a price-earnings multiple of 158.5. The price to adjusted operating cash flow multiple is 57.7. And the EV/EBITDA multiple should be 38. Even if we were to assume that earnings and cash flow would triple rather than double over this period, those multiples would look rather high at 112.7, 40.3 and 26. .7, respectively. To put it all into perspective, I decided to compare the company to five similar companies. On a price-earnings basis, these companies ranged from a low of 6.2 to a high of 87.7. Using the price/operating cash flow approach, the range was 6.1 to 13.9. And using the EV to EBITDA approach, the range was 3.4 to 12.9. In all three scenarios, Kura Sushi USA was more expensive than all other group members. Even taking the most liberal approach, this remains true in all areas.

| Company | Prizes / Earnings | Price / Operating Cash | EV / EBITDA |

| Kura Sushi United States | 158.5 | 57.7 | 38.0 |

| Barbecue fund (BBQ) | 6.2 | 6.1 | 3.4 |

| Arcos Dorados Holdings (ARCO) | 70.8 | 8.3 | 11.8 |

| Texas Roadhouse (TXRH) | 23.7 | 12.4 | 12.9 |

| Darden (DRI) Restaurants | 18.9 | 13.9 | 12.5 |

| Potbelly Corp (PBPB) | 87.7 | 11.6 | 11.8 |

Carry

Right now, Kura Sushi USA seems like a fascinating growth prospect to me. But that doesn’t mean investors have to climb to buy stocks. While I suspect the best days for the company are ahead, I think stocks look significantly overvalued at the moment. Generally speaking, I’m hesitant to recommend shorting fast-growing companies. But at a minimum, investors should consider staying away and waiting for a more attractive price.

Comments are closed.